Sticking with a book to the very end

A review of The Power Law: Venture Capital and the Art of Disruption, by Sebastian Mallaby

A disappointing read

I knew that I'd love this book. It's about investing, and what more exciting way is there to plough a buck into a company than venture capital? And the author is a long-time Economist writer, a magazine with which I'm obsessed. Yet by about page 200, I got bored.

It descended into a stenographic report of "this happened, Series A, and then this other fund blah blah, Series B, and they struggled blah blah, Series C." I finished the book because I'm determined in that way (or, as my mum says, stubborn).

The book lacked soul. I spent 400 pages in the company of Mallaby, but know little about him. I contrast it to The Intelligent Investor by Benjamin Graham and The Wealth and Poverty of Nations by David Landes. Both are daunting intellectuals, but beyond dazzling us with facts they impart into their writings something of their spirit.

Some good moments

Buried in the dreariness of it all, I looked back and found a few bits that I’d highlighted on my Kindle:

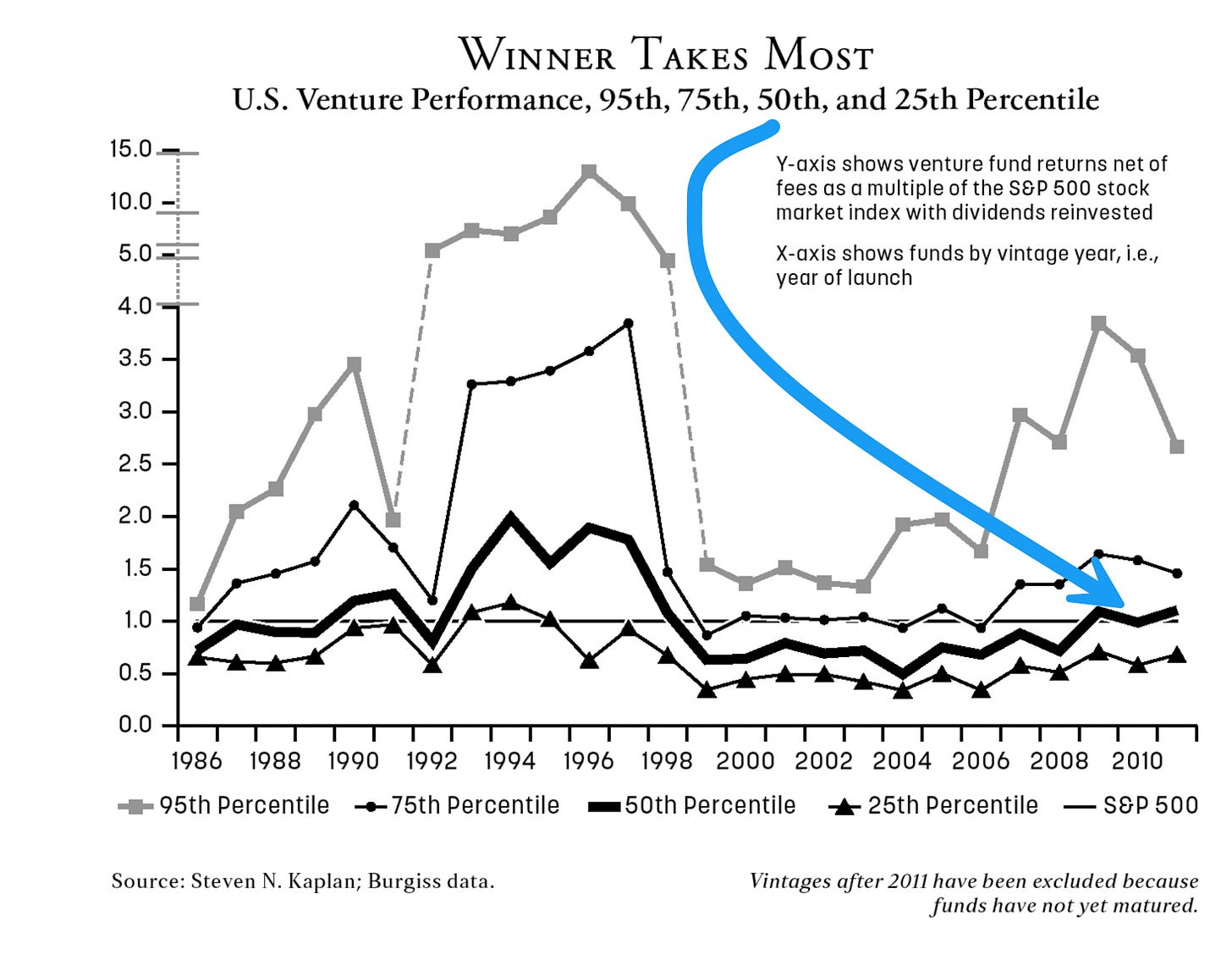

(1) Venture capital, on average, underperforms:

Counting venture funds raised between 1979 and 2018, the median fund narrowly underperformed the stock market index, whereas the top 5 percent of funds trounced it.

(2) The power law vs. the normal distribution:

In a normal distribution, moreover, you can remove the biggest outlier from a sample without affecting the average: if a seven-foot NBA star walks out of a cinema, the average height of the remaining ninety-nine movie-watching men falls from five feet 10 inches to five feet 9.9 inches. In a non-normal, skewed distribution, in contrast, the outliers can have a dramatic effect. If Jeff Bezos walks out of the cinema, the average wealth of those who stay behind will plummet.

(3) The power law fuels venture capital returns:

Y Combinator, which backs fledgling tech startups, calculated in 2012 that three-quarters of its gains came from just 2 of the 280 outfits it had bet on.“The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund,” the venture capitalist Peter Thiel has written.

Searching for Sugar Man

In the last chapter, on page 375, a gem emerges. Is success in venture capital, asks Mallaby, based on skill or down to luck? Much in life appears to be random. For example, the story of the songwriter, Rodriguez. They said about him that “in comparison, Bod Dylan was mild” and expectations were high when he released his album, Cold Facts, in 1970. He sold six copies. Skills and outcome, it appears, do not always go hand in hand.

Rodriguez spent the remainder of his career as a manual labourer, a demolition man. A tragedy. The documentary, Searching for Sugar Man, tells his story and I cried and I smiled, and I kept Googling to check that this was a true story (it is). For this alone, it was worth trawling through 400 pages.